Waterfall

Waterfall is a traditional way of managing business and investment projects where tasks are completed in a specific sequence, like water flowing down steps. It's commonly used in venture capital and investment firms to manage funding rounds, due diligence processes, and portfolio company development. Unlike more flexible approaches, Waterfall requires completing and approving each phase before moving to the next one. This structured approach helps investors and project managers maintain clear documentation and track progress, which is particularly important when dealing with large investments or complex business developments.

Examples in Resumes

Managed $50M investment portfolio using Waterfall methodology for tracking and reporting

Led due diligence processes following Waterfall approach for 12 startup investments

Implemented Waterfall project management to streamline venture funding operations

Typical job title: "Venture Capital Analysts"

Also try searching for:

Where to Find Venture Capital Analysts

Professional Networks

Job Boards

Industry Resources

Example Interview Questions

Senior Level Questions

Q: How do you adapt Waterfall methodology for venture capital operations?

Expected Answer: A senior professional should discuss how they structure investment phases, from initial screening to post-investment monitoring, ensuring each step is properly documented and validated before proceeding. They should explain how they maintain flexibility while keeping the structured approach.

Q: How do you handle risk management in a Waterfall approach to investments?

Expected Answer: The answer should cover how they identify, document, and mitigate risks at each phase of the investment process, including due diligence checkpoints and approval gates, while maintaining clear documentation for stakeholders.

Mid Level Questions

Q: What documentation do you prepare at each stage of the Waterfall investment process?

Expected Answer: Should describe the key documents created during screening, due diligence, investment committee presentations, and post-investment monitoring, emphasizing the importance of thorough documentation at each phase.

Q: How do you track progress in a Waterfall investment approach?

Expected Answer: Should explain their methods for monitoring investment stages, including tools used, key metrics tracked, and how they communicate progress to stakeholders.

Junior Level Questions

Q: What are the main phases in a Waterfall approach to venture capital investments?

Expected Answer: Should identify the basic stages: deal sourcing, initial screening, due diligence, investment decision, deal closing, and portfolio management, understanding that each must be completed before moving forward.

Q: Why is documentation important in the Waterfall method?

Expected Answer: Should explain how proper documentation helps track progress, maintain accountability, and provide clear records for stakeholders and regulatory compliance.

Experience Level Indicators

Junior (0-2 years)

- Basic understanding of investment processes

- Document preparation and management

- Investment data tracking

- Basic financial analysis

Mid (2-5 years)

- Due diligence management

- Investment process optimization

- Stakeholder communication

- Risk assessment

Senior (5+ years)

- Investment strategy development

- Portfolio management

- Process improvement

- Team leadership

Red Flags to Watch For

- Lack of attention to documentation and process details

- Poor understanding of investment stages and sequences

- Inability to explain decision-making processes

- Limited knowledge of due diligence requirements

Related Terms

Need more hiring wisdom? Check these out...

The $100M Mistake: Hidden Costs of Rushed Leadership Hires (Data Study)

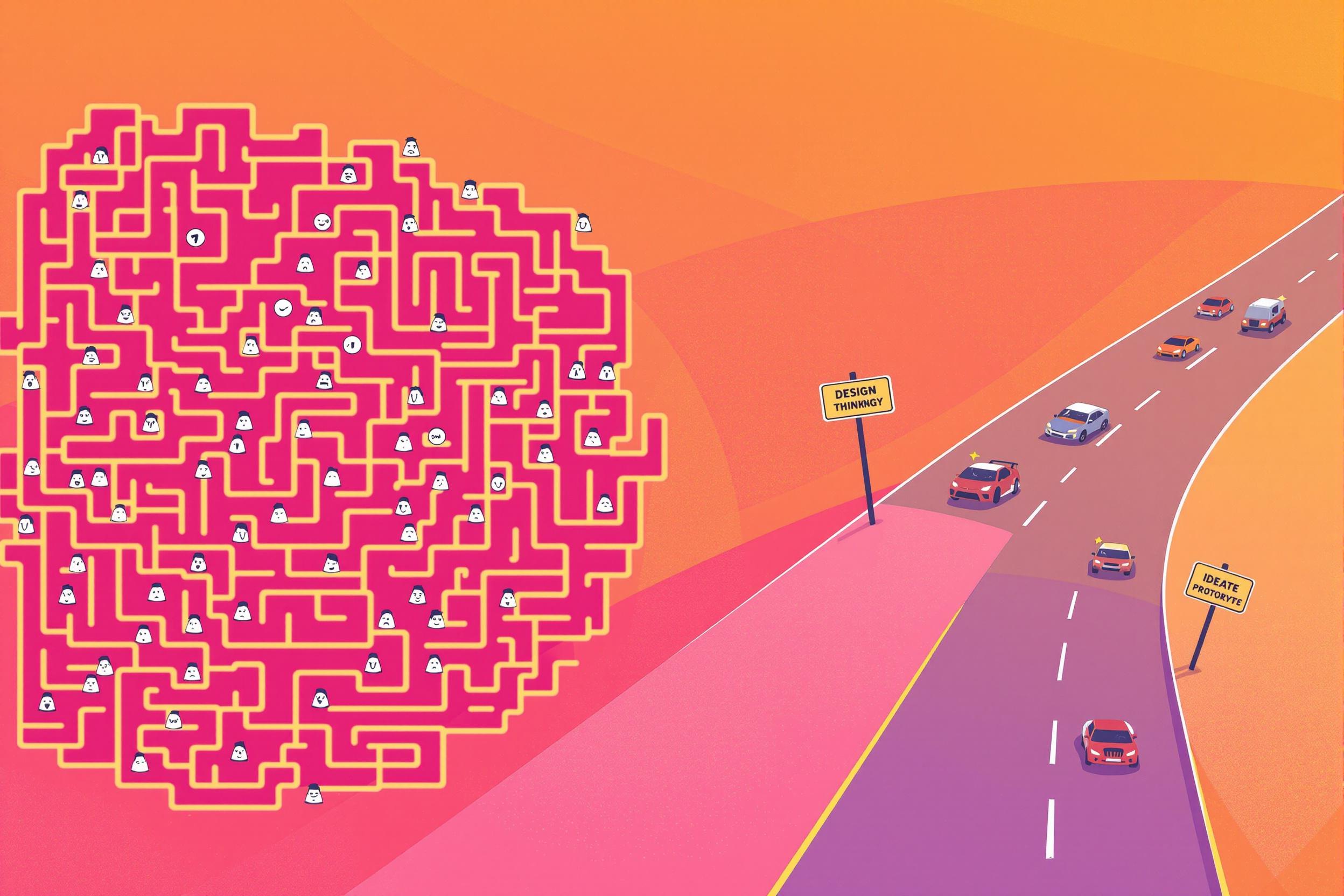

Why Your Hiring Process is a Maze (And How Design Thinking Can Turn It into a Superhighway)

Workforce Solutions Aggregators: The Next Big Thing You Didn't Know You Needed